«GrainLogistics 2021: Logistics of grain and oilseed exports»

International conference

RESULTS

On the 28th of April 2021, the first International "Logistics of grain and oilseed exports" conference finished its work in Novorossiysk. More than 250 delegates from Russia and Kazakhstan gathered in the largest port on the south of Russia to discuss current grain exports issues.

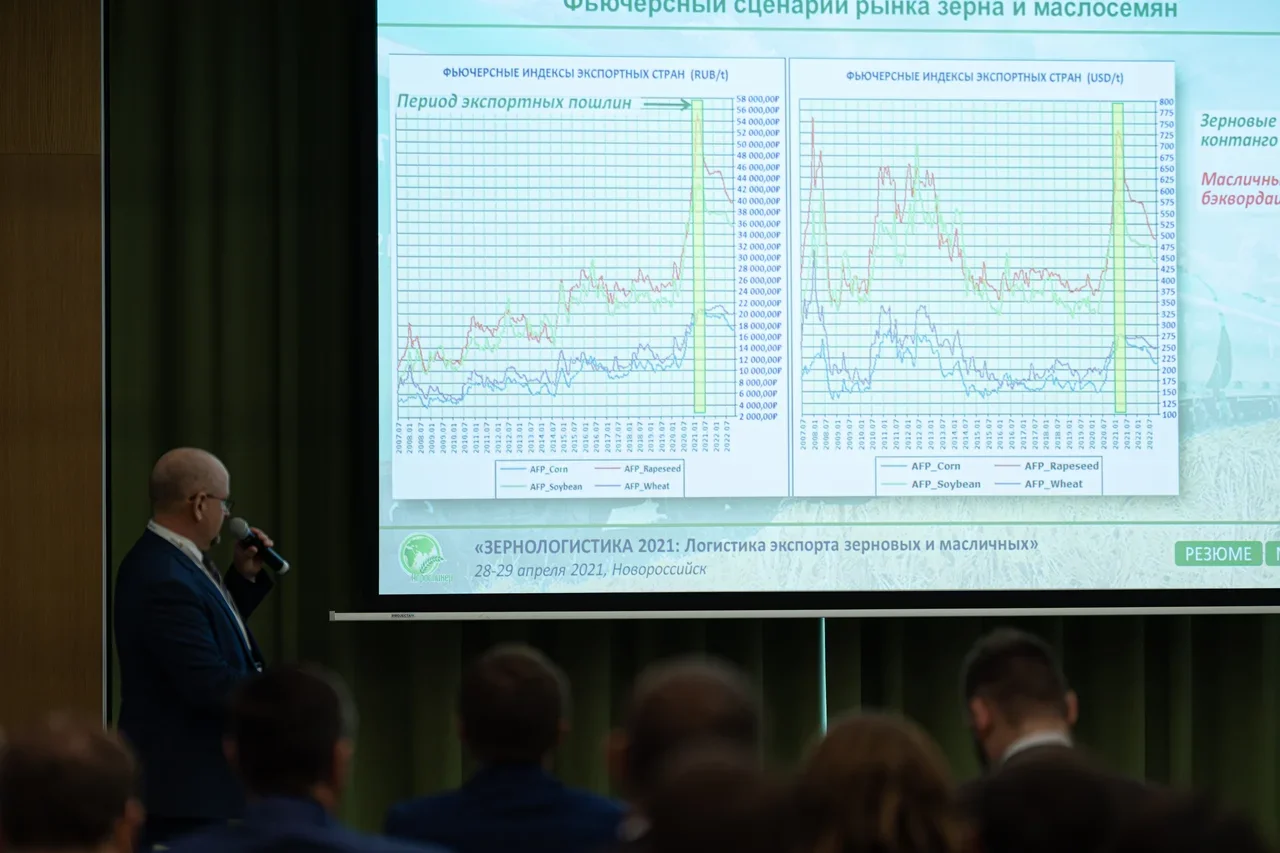

The conference started with a report by Vitaly Shamaev, “Agrospeaker” company CEO. Vitaly made a price forecast for main export positions. But the main topic of his speech was about the problem of new export duties which contribute to the loss of Russian grain competitiveness on the world market. Domestic traders have already started to lose international tenders – buyers do not want to take risks. The duties will hit all investment projects in the agricultural sector and logistics with a knockout effect. In addition, these duties will help to reduce the dominance of wheat in the crop rotation: corn crops and oilseed wedge increase. As a result, Russia will receive the gross product of arable land increase at the expense of more expensive oilseeds and high-yielding corn and domestic wheat prices will still rise due to a decrease in its share of production.

Next speaker, Mikhail Khanov, Federal State-Funded Institution “Federal Centre of Quality and Safety Assurance for Grain and Grain products” Novorossiysk branch director elaborated on the topic of grain exports for the first 6 months of the 2020-21 agricultural year. So far, the numbers are optimistic. Over the past 30 years our country has grown from being the largest wheat importer to an export leader: we are first in wheat exports (20% of the world's total) and third in the world in grain exports (11% of the world's total). As of the 15th of April 2021, the country exported 51.7 million tons of grain and its processed products (+13% compared to the previous season), including grain crops – 44.3 million tons (+18% compared to the 2019/20 season). An increase in purchases of Russian grain was shown by the countries of North Africa (+36%) and West Africa (+21%).

The speaker emphasized that in the current season Russia exported a record 35.6 million tons of wheat, which is 17% more than last year. Traditionally, Turkey purchases the main volumes of class 3 wheat for its flour milling industry - 35% of the total volume of Russian exports, followed by Azerbaijan (22%) and Kazakhstan (16%). Class 4 wheat was purchased by Egypt (26% of Russian exports), Turkey (15%), Pakistan (5%) and Bangladesh (5%). Almost all the feed grain went to the Philippines (26%), Turkey (21%) and Thailand (17%). In addition, Russia exported a record 5.6 million tons of barley, which is 58% more than last season.

As for compliance with the requirements for the quality of Russian grain, in this matter, so far, everything is not so good. According to the results of the last season, 82 countries presented their claims for quality, 101 countries for safety, and 125 countries for phytosanitary conditions. Lithuania filed claims for increased residual content of grain pesticides that exceed the norms allowed in the EEC. Due to the content of thistle seeds in Russian wheat, the Vietnamese market is almost lost (- 69% since 2019), which previously purchased up to 2.1 million tons per season.

The topic of export was continued by Ilya Ilyushin, who elaborated on the logistics of vegetable oils. Thus, Russia is the second largest producer of sunflower with a volume of 13.3 million tons and a share of 27% of world production. At the same time, the export of sunflower seeds in the 20/21 season will be about 600 thousand tons. The projected volume of processing in the 20/21 season will be 12.8 million tons. Russia is also the second producer of sunflower oil in the world with a volume of 5.1 million tons and a share of 27%. The planned volume of sunflower oil exports from Russia in the 20/21 season will be 2.9 million tons. According to the expert, considering the duties introduction, as well as the projected growth of the crop in 2021/22, exports next season may become a record.

The main purchasers of Russian sunflower oil in the first half of the 20/21 season were: Turkey, China, Iran, India, Egypt with a total volume of 86%. At the same time, the supply of sunflower oil from Russia to China and India has great prospects. India imports about 2.5 million tons and China about 1.1 million tons of sunflower oil per year.

As for the plans of the oil and fat industry development in Russia for the future 2021-2025, it is worth noting several important points. It can be confidently predicted an increase in the production and processing of oilseeds to 29 million tons due to an increase in the acreage for sunflower as well as an increase in the production of soybeans and rapeseed. In the coming years there will be a yield increase due to the optimization of food elements and the correct approaches to cultivation technology. In addition, new processing facilities will soon be put into operation at the “Chernozemye”, “Cherkizovo”, “Sodruzhestvo” and “Miratorg” holdings.

According to Ilya, an additional incentive for the oil exports growth can be projects of creation of additional production facilities in importing countries, where Russian oil would be refined and bottled. We have where to grow - the sunflower oil demand in the world is gradually increasing, people are switching to more useful products and they see the transition to the use of sunflower oil as one of the factors of healthy nutrition. Today our problem is the availability of the export product. For example, Ukraine which is the world sunflower oil market leader, exports about 6 million tons, twice the size of Russia.

Over the past two years, there has been a huge breakthrough in the markets of India and China, where Ukrainian oil has gone to. The main difficulty of these markets is that they buy lots of 30-40 thousand tons. Unfortunately, Russia does not have enough deep-water terminals that could accumulate large volumes of oil and ship tankers with a volume of 30-40 thousand tons. Russia urgently needs an independent deep-water terminal that offers its services at rates close to the global ones. So far, there is not even one in the project.

The conference participants were particularly interested in the speech of Igor Pavensky, “Rusagrotrans” company department director, in which were highlighted the current trends in the infrastructure and railway transportation of grain cargo development. According to his speech, the forecast of grain harvest in 2021 is 128 million tons, wheat - 80.6 million tons. Winter crop prospects have increased in recent weeks due to heavy rainfall in the southern and central regions. This significantly improved the condition of winter crops in the southern region (Stavropol territory, Rostov, and Volgograd regions) affected by the autumn drought, increased the yield potential in the Krasnodar territory and removed the threat of spring drought in the central federal district.

The export potential for grain in the new season 2021/22, considering the current production forecast and sharply increased stocks, may be about 51 million tons, including wheat – 40.5 million tons. As for exports from ports, shipments in the ports of the Caspian Sea (-28%) and Tuapse (-18%) decreased in July 2020-March 2021. The port of Kavkaz increased its shipment by 1.5 times - to 11.33 million tons (+51%), Taman - from 2.4 to 2.9 million tons (+21%), small ports of the Azov Sea and the Don, against the background of increased shipments to Turkey, increased exports to 6.1 million tons against 5.65 million tons a year earlier (+8%).

The speaker highlighted the significant growth of Russian exports through the Baltic ports, including Finland - by 2.2 times (+120%) against the background of record crop volumes in the center of Russia, the congestion of ports in the south of Russia and problems with the harvest in Europe. Shipments to Azerbaijan increased (+20%). Novorossiysk shipped with a record pace - 21% higher than last season's level.

Egypt again took the first place in the ranking of the largest importing countries of Russian wheat – 7.93 million tons. Turkey moved to the second place – 6.27 million tons of grain. Bangladesh (3rd place) almost retains last year's level of wheat purchases from Russia, slightly increasing it – 1.863 million tons. Interestingly that Pakistan increased its wheat imports from zero to 1.51 million tons. The main supplies to this country are provided by Russia and Ukraine. Azerbaijan increased the import of Russian wheat by 21.9%. Significant growth is recorded in individual countries of East Asia - Philippines (from 175 to 540 thousand), Thailand (from zero last season to 309 thousand tons), as well as Mongolia (from 55 to 245 thousand tons), South Korea (from 0.4 to 86.1 thousand tons). Russian wheat exports to Iran increased by 6.7% – from 1.15 to 1.22 million tons (last season, active deliveries to Iran began only at the end of 2019). Deliveries to some African countries (Nigeria, Kenya, Senegal, Angola, Congo) increased. After 4-year break deliveries to Saudi Arabia resumed -123.5 thousand tons. For the first time since the 2018/19 season, wheat deliveries to Jordan began. It was imported 228.1 thousand tons from Russia. Exports to Brazil are growing, even though this market is extremely competitive with Argentina: in 2018/19 for the entire season - 26.2 thousand tons, in 2019/20-91.7 thousand tons, and in 2020/21, 237.6 thousand tons have already been exported.

Asian countries increased the import of Russian wheat by 36.5% to 5.15 million tons (the share of the destination is 15%) mainly due to supplies to East Asia (Mongolia, the Republic of Korea, China) and South Asia (Pakistan, Bangladesh). Shipments to Southeast Asian countries generally declined. However, the growth of exports to the Philippines and Thailand to some extent smoothed out the reduction in supplies to Vietnam (where there is high competition between Ukraine, Australia, and the United States) and the lack of exports to Indonesia (in this market there is also high competition from Ukraine which supplies large volumes there for the second season - 2.6 and 2.2 million tons).

In the speech of Olga Gopkalo, “Morstroytechnology” company chief specialist, there was an information about the Russian port infrastructure development for grain export. The topic is important, as almost 90% of domestic grain exports go through seaports. The main export regions are in the south of Russia, and the main export ports are also located here. 94% of Russian grain is transshipped in the ports of the Azov-Black Sea basin. At the same time, the volume of transshipment in the Caspian Sea and the Far East is growing.

As for the results of the past year. Deep-water ports (Novorossiysk, Taman, Tuapse), which allow receiving Handysize vessels (with a deadweight of 30-40 thousand tons) and, with some restrictions, Panamax (with a deadweight of 55-70 thousand tons), handled 21.5 million tons of grain cargo in 2020. Shallow-water ports of the Sea of Azov, receiving vessels with a deadweight of 3-5, less than 8 thousand tons, shipped 18.0 million tons in 2020. The Volga and Don river ports (vessels with a deadweight of about 3 thousand tons) processed 1.2 million tons in 2020. The roadstead at the port of Kavkaz handled 7.5 million tons last year.

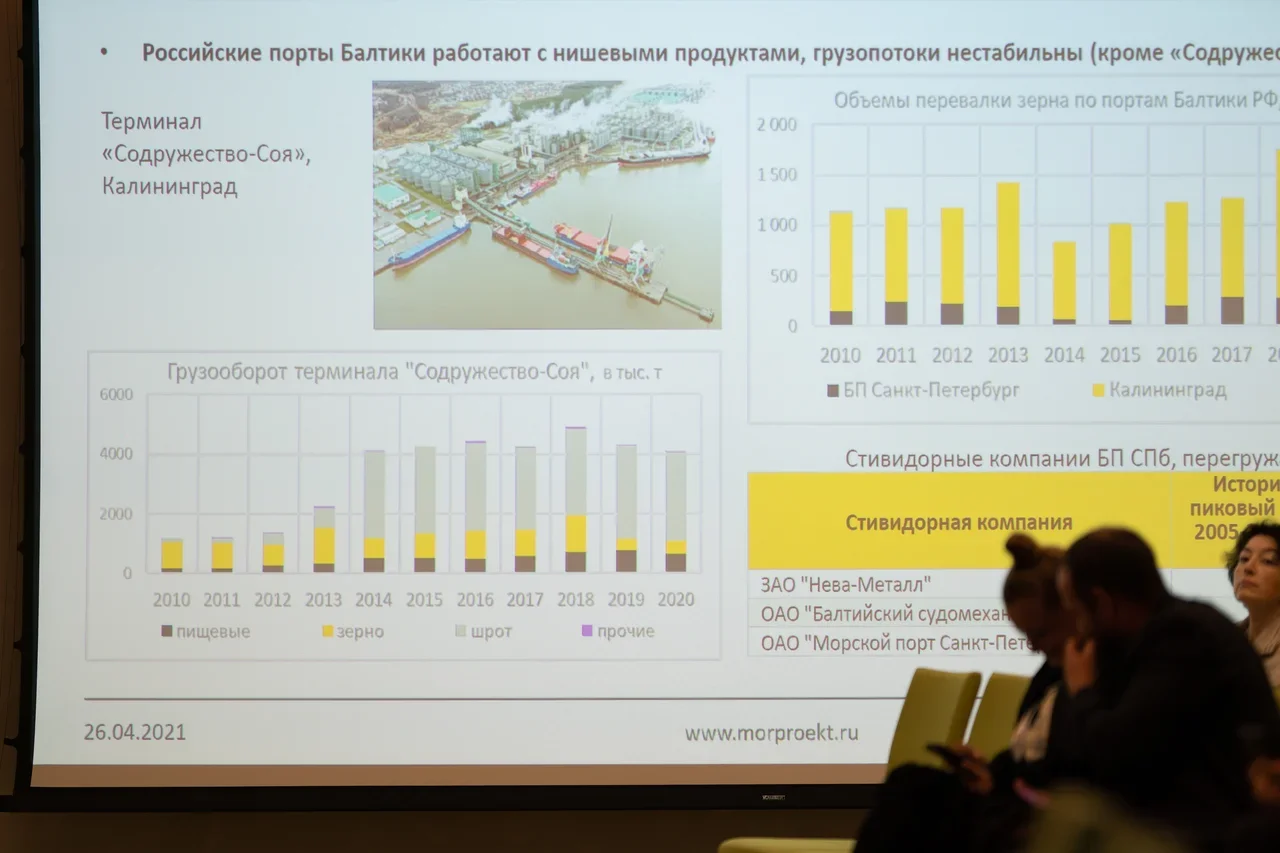

As Olga Gopkalo noted, last year the ports on the Volga showed good transshipment dynamics growth. Here the main merit is at the port of Togliatti, which put into operation a new grain storage warehouse. But the Russian Baltic ports work exclusively with niche products, and their cargo flows are still unstable (except for the Sodruzhestvo-Soya terminal).

Perhaps the situation in the Baltic Sea will change soon due to construction of four specialized grain terminals has been announced in this region. One of them - the port of Vysotsky, is close to implementation. As Andrey Garnukhin, a member of the board of directors of Port Vysotsky LLC, said at the conference, this terminal will be the first complex for transshipment of grain in the Baltic Sea. Its opening will take place in 2022. The planned volume of transshipment is 4 million tons per year. The unique feature of the terminal is the absence of chain conveyors and burrows in the overload technology, which will ensure high stability of the complex.

Alla Postnikova, head of commercial department in Novosibirsk branch of “Eurosib SPb – transport systems” company, highlighted the company's experience in organizing a service for the transportation of grain crops from Siberia for export to China.

Oleg Bolkhovityanov, “RUFCO” CEO, presented the analysis of the grain cargo freight market in the Black Sea-Caspian basin. The topic of marine logistics was continued by Nadezhda Balashchenko, “TMBCL Ltd.” deputy director, who highlighted the topic of risk management of ocean grain cargo transportation in the volatile freight market. In turn, Alexander Lisin, associate professor of the transport management department at VSUWT, reported on the state of river grain transportation.

A separate session was devoted to technical issues of grain transshipment. In particular, Sos Kazaryan, "Europac" sales director, shared the experience of grain cargo containerization. Evgeny Kudryavtsev, "RAM SMAG Lifting Technologies" sales manager, presented an innovative elaboration from Australia - special containers for grain. Finally, Sergey Ralovets, "RM Rail Engineering" managing director, shared the results of freight cars with aluminum alloy bodies for grain transportation testing.

As the conference delegates noted, the business program was full of relevant and important reports for the entire grain industry. The discussion of the problems of Russian agrologistics on this day continued in an informal atmosphere, during the dinner in the restaurant of one of the most modern Russian wineries - "Chateau Pinot". This gravity winery is located at an altitude of 280 meters above sea level in the suburbs of Novorossiysk. The delegates of the conference spent this eventful day enjoying the stunning view: the sunset over the Tsemesskaya Bay.

The second day of the grain forum was completely devoted to the continuation of conference delegates informal communication. Sightseeing tour of the city of Novorossiysk with a visit to the famous factory of champagne wines "Abrau-Durso" was organized for them. In the former tsar's estate, they were invited to visit the unique cellars with a tasting of the best Russian soft and sparkling wine.

Considering the success of the event, the organizing committee of the forum decided to make the conference "Logistics of grain and oilseed Exports" annual.

Draft conference program

9.00-10.00 Participants registration

Conference moderator – Shamaev Vitaly, “Agrospeaker” company CEO

10.00-11.30 I session.

- Ministry of Agriculture of the Russian Federation report

- Grain and vegetable oils export regulation in current agricultural year.

- /speaker is being specified/

- Far East Investment and Export Agency report

- Creation of grain export infrastructure in the Far East.

- Sementsov Roman, transport and logistics infrastructure director

- FSFI report

- Grain and its processed products export for the first 6 months of the 2020-21 agricultural year.

- Khanov Mikhail, Novorossiysk branch director

- Vegetable oils export problems. Where to find a solution? report

- Ilyushin Ilya, independent expert

- Prospects for the railway capacity increasing to the ports of the South of Russia report

- /speaker is being specified/

11.30-12.00 coffee-break

12.00-13.30 II session.

- UGC report

- From the field to the ship's side: prospects for the grain statistics development and port transshipment capacities expansion.

- Bolomatova Ksenia, deputy CEO

- Rusagrotrans report

- Infrastructure development and railway transportation of grain cargo current trends.

- Pavenskiy Igor, department director

- Morstroytechnology report

- Grain export infrastructure. Sea terminals.

- Gopkalo Olga, chief specialist

- Port Vysotsky report

- Project of grain terminal in Baltic creation.

- /speaker is being specified/

13.30-14.30 Lunch.

14.30-16.00 II session.

- SGS report

- Current year grain quality analysis and Russian grain competitiveness in the world market.

- Sarycheva Irina, customer service manager and agricultural department technical supervision

- Volga State University of Water Transport report

- River grain transportation: state, prospects of development.

- Lisin Alexander, associate professor of transport management department

- RUFCO report

- Grain cargo freight market in the Black Sea-Caspian basin analysis.

- Bolkhovityanov Oleg, CEO

- Marine Engineering Bureau report

- Trends in the design of the modern dry cargo "river-sea" fleet. The state of the Russian fleet for the transportation of grain cargo.

- Egorov Gennady, CEO

16.00-16.30 IV session. Trends in the development of agricultural products logistics

- Eurosib SPb – transport systems report

- Grain crops transportation from Siberia to export service organization experience.

- Postnikova Alla, head of Novosibirsk branch commercial department

- PRECIA MOLEN Russia report

- Accounting at a modern grain terminal. High-precision reliable weighing equipment.

- Samsonov Artem, Russia and CIS manager

- Russian Aluminum Association report

- Cargo wagons with aluminum alloy body for grain transportation.

- Drobzhev Sergey, RM Rail company technical development director

- Russian Aluminum Association report

- Granaries made of aluminum.

- Kalinin Dmitry, RUSAL company “Construction” sector head of projects

- RAM SMAG Lifting Technologies

- Special containers for grain: convenient and fast transportation.

- Kudryavtsev Evgeniy, sales manager Russia and CIS

18.00 Grain Gala Dinner

Participants Conferences

Participation Terms

Place of holding

Hilton Garden Inn Novorossiysk

Hilton Garden Inn Novorossiysk is located in the heart of the city, 100 m from the Black Sea coast and offers views of the famous Cape of Love. The Museum Cruiser Mikhail Kutuzov is within a 15-minute walk by the city embankment, and Novorossiysk sea port is 1.2 mi away. Free WiFi is featured throughout the property.

Each air-conditioned room at this hotel offers a desk with an ergonomic chair, mini fridge and flat-screen TV with satellite channels.

Guests are welcome to dine at Garden Grill&Bar restaurant. An evening room service is also available.

Other facilities include wellness area with a gym. There is also a business center where guests can use computer, fax machine and photocopier. The hotel provides 750 square yards of event space as well.

- Address: Naberezhnaya imeni Admirala Serebryakova 29G, 353905 Novorossiysk

- phone: +7 861 7767600

- www.hilton.ru/hotels/hilton-garden-inn-novorossiysk